vermont state tax brackets

4 rows Tax rate of 66 on taxable income between 40351 and 97800. Tuesday January 25 2022 - 1200.

Regarding Eisenhower S Tax Rates We Should Listen To Jfk Rather Than Bernie Sanders International Liberty

Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate.

. Groceries clothing prescription drugs and non-prescription drugs are exempt from the. The highest bracket of 875 starts for income greater than 200000. As you can see your Vermont income is taxed at different rates within the given tax brackets.

And your filing status is. The Vermont State Tax Tables below are a snapshot of the tax rates and thresholds in Vermont they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates. Tax rate of 76 on taxable.

2019 VT Rate Schedules. What is the income tax rate in Vermont. The site is secure.

2021 Vermont Tax Tables. Tax Year 2021 Personal Income Tax - VT Rate Schedules. At Least But Less Single Married Married Head of.

Than filing filing house- jointly. Before sharing sensitive information make sure youre on a state government site. 2018 VT Tax Tables.

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. TAX TABLES Place at. It ranges from 335 to 875.

Tuesday January 25 2022 - 1200. Local Option Meals and Rooms Tax. The Vermont State Tax Tables below are a snapshot of the tax rates and thresholds in Vermont they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875. If Taxable Income is.

2020 Income Tax Withholding Instructions Tables and Charts. State government websites often end in gov or mil. 9 Vermont Meals Rooms Tax Schedule.

Vermonts tax system ranks. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15. Before sharing sensitive information make sure youre on a state government site.

State government websites often end in gov or mil. Any sales tax that is collected belongs to the state and does. The site is secure.

2018 VT Rate Schedules. Local Option Alcoholic Beverage Tax. State Business Taxes in Vermont The state of Vermont has a.

4 rows Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. 2019 VT Tax Tables.

6 Vermont Sales Tax Schedule. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Vermont.

State Tax Levels In The United States Wikipedia

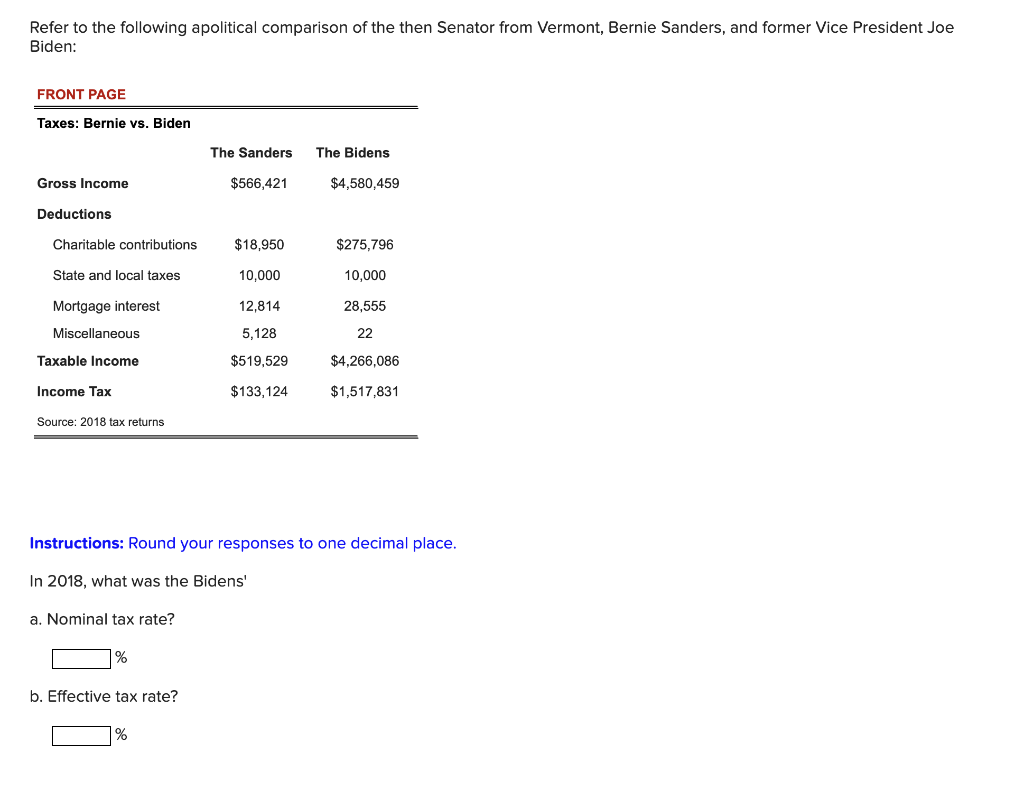

Solved Refer To The Following Apolitical Comparison Of The Chegg Com

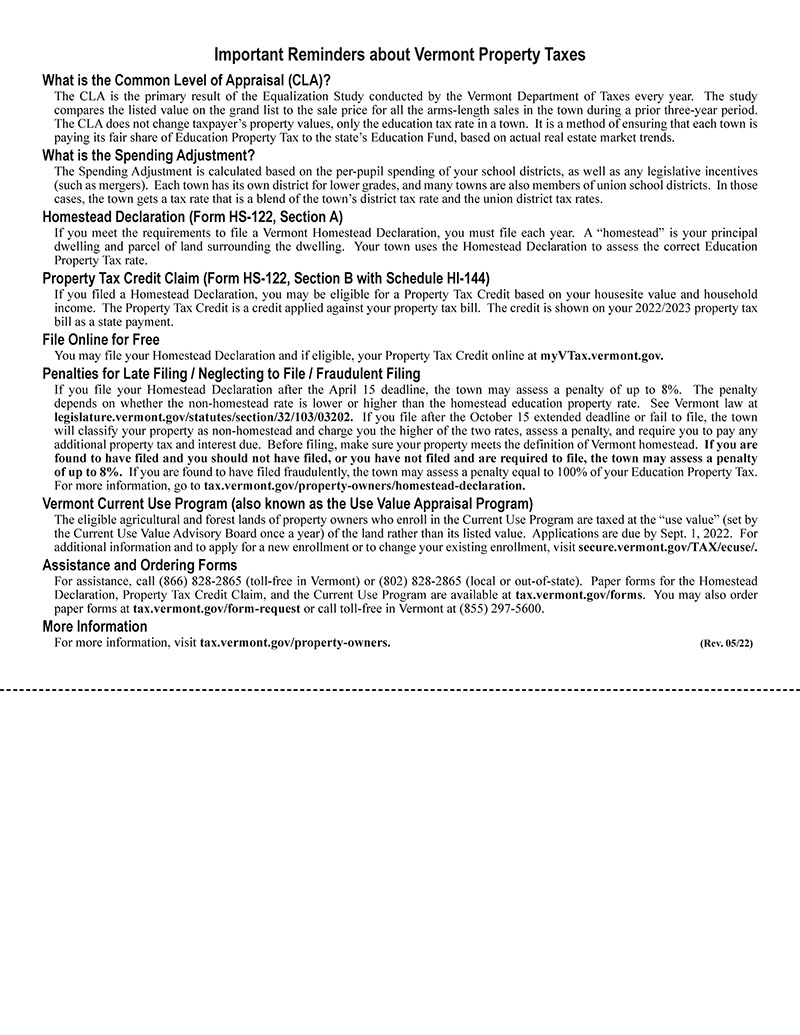

Understanding Your Property Tax Bill Department Of Taxes

Vermont Tax Brackets And Rates 2022 Tax Rate Info

Utah Income Tax Rate And Brackets 2019

Vermont State Tax Tables 2022 Us Icalculator

4th Highest Property Tax Rate Nationwide R Vermont

How Do Marijuana Taxes Work Tax Policy Center

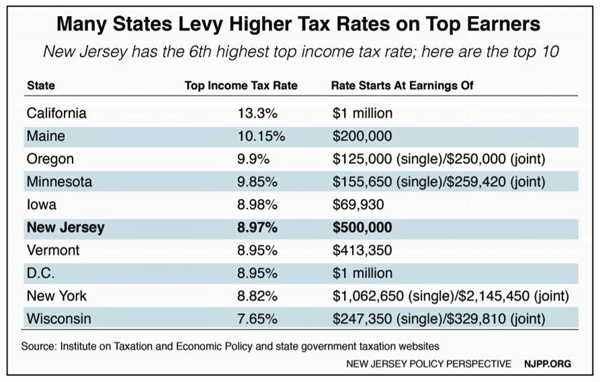

The Provocative Millionaire S Tax Its Potential And Past In N J Whyy

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Learn More About The Massachusetts State Tax Rate H R Block

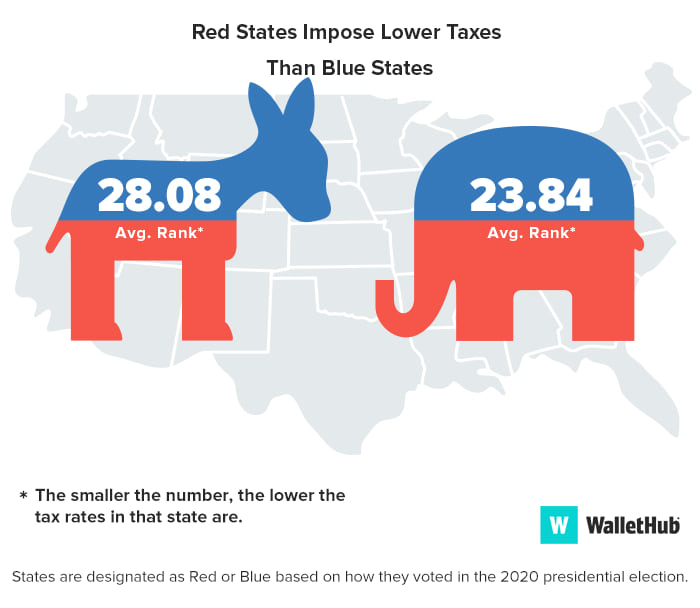

States With The Highest Lowest Tax Rates

Vermont Income Tax Vt State Tax Calculator Community Tax

File State And Local Sales Tax Rates Pdf Wikimedia Commons

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation